Universal Life Plans versus Whole Life Plans

Before anyone settles down on any type of insurance in Singapore, a consultation with a financial adviser is fully recommended. All the more so for life insurance, where a commitment is required for life. Owners should understand what they are investing in before signing on that sheet of paper. There are two types of life insurance in Singapore – Universal Life Plans and Whole Life Plans. Though both are life insurance, they cater to people with different needs and wants. Below are a few listed differences of a Universal Life Plan and a...

read moreKeyman Business Insurance & Share Protection Business Insurance

Starting up a business isn’t easy and maintaining it definitely isn’t: so why risk it? Every business carries elements of risk: so just like how you can protect yourself and your family with Universal life insurance, protect your business as well with Keyman Business Insurance and Share Protection Business Insurance. These are permanent insurance solutions that ensure the continuity of your business come hell or high water whether you are based in Singapore, Indonesia, Hong Kong or China. In most companies, there are one or two key...

read moreKnow it, prevent it, be prepared for it with Universal Life Insurance in Singapore

Singapore – Be it hereditary or acquired, there isn’t a way to know if you will be the next victim. It creeps in slowly and stealthily, taking you by surprise. The occurrences are just too high, and till today it remains the number 1 killer in Singapore: Cancer. 1 in 3 dies of cancer, 14 die of cancer every day, and 28 diagnosed with cancer every day. Since death is universal and there is no escape It is time you seriously give Permanent Life Insurance a thought. Following cancer, heart disease, pneumonia, and brain dysfunctions are...

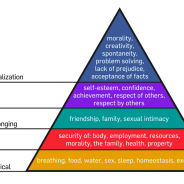

read moreLife Insurance in Singapore and The Hierarchy of Financial Planning

At every stage in life, planning is always crucial. Life insurance in Singapore is part of the whole financial planning process. The importance of financial planning is reinforced by the Singapore government in the form of the Central Provident Funds (CPF) scheme. This again strongly emphasizes the importance of financial independence in our society. Furthermore, there is a limit to the extent to which the government can extend their grants to aid us. With skyrocketing costs and the rising standard of living within our society, we are only...

read more