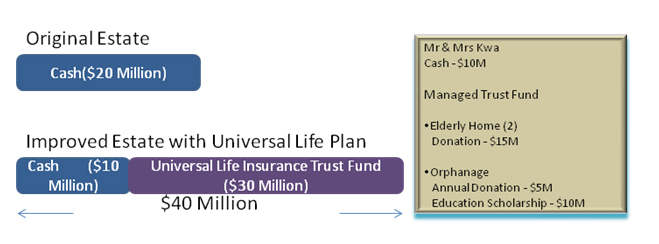

Mr. & Mrs. Kwa, both 50 years of age, had successfully established their own business, which they sold away at the age of 45 and went into early retirement. With no children or living parents, they had cash holdings of $ 20 Million. Both of them were actively involved in volunteer work after their retirement.

Mr. & Mrs. Kwa, both 50 years of age, had successfully established their own business, which they sold away at the age of 45 and went into early retirement. With no children or living parents, they had cash holdings of $ 20 Million. Both of them were actively involved in volunteer work after their retirement.

Mr. Kwa has been helping out at two elderly homes. He took out a $ 5 Million Premium Universal Life Plan which he placed under a trust. The coverage of which is valued at $ 15 million. This served as a medical care subsidy fund for the two elderly homes he is currently volunteering at.

Meanwhile, Mrs. Kwa does volunteer work for a local orphanage and an overseas orphanage in Cambodia. Like her husband, she has taken a $ 5 Million Premium Universal Life Plan with a coverage of $ 15 million. The said trust will serve two purposes; one, to provide an annual donation to both the orphanages and two, to provide an education scholarship for the children in the orphanages.

Both Mr. & Mrs. Kwa’s trust funds will be managed by an investment management firm to generate consistent returns.