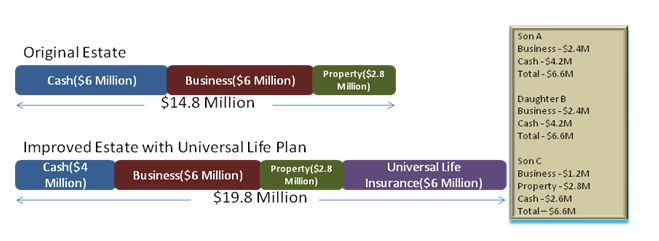

Mr. & Mrs Ang , both aged 65 have 3 children; Son A, Daughter B and Son C. All of their children are married and have children of their own. The youngest of their grand children is from Son C, who is only about one (1) month old. Their hard work has paved the way for them to acquire a $ 2.8 million house, a business valued at $ 6 Million and cash worth $ 6 million.

Mr. & Mrs Ang , both aged 65 have 3 children; Son A, Daughter B and Son C. All of their children are married and have children of their own. The youngest of their grand children is from Son C, who is only about one (1) month old. Their hard work has paved the way for them to acquire a $ 2.8 million house, a business valued at $ 6 Million and cash worth $ 6 million.

Both Son A and Daughter B have businesses of their own. Meanwhile, they are very concerned about Son C who isn’t as well off as his 2 siblings and is living a spendthrift lifestyle.

Mr. & Mrs Ang have then decided to buy $ 1 million premium Universal Life Plan for each of them and got ensured of $ 3 Million each. They have willed the proceeds to the surviving party. Should both of them pass away, the proceeds distribution will follow that of the will arrangements. Son A will get 40% of the business, valued at $ 2.4 Million plus $ 4.2 Million of cash. Daughter B will also get the same amount which is 40% of the business valued at $ 2.4 and $ 4.2 Million in cash. Meanwhile, Son C shall get 20% of the business valued at 1.2 million, house valued at 2.8 million and cash of $ 2.6 Million. Son C can opt to sell away the house only after his youngest child (youngest grandchild of Mr. & Mrs. Ang) reaches the age of 30.